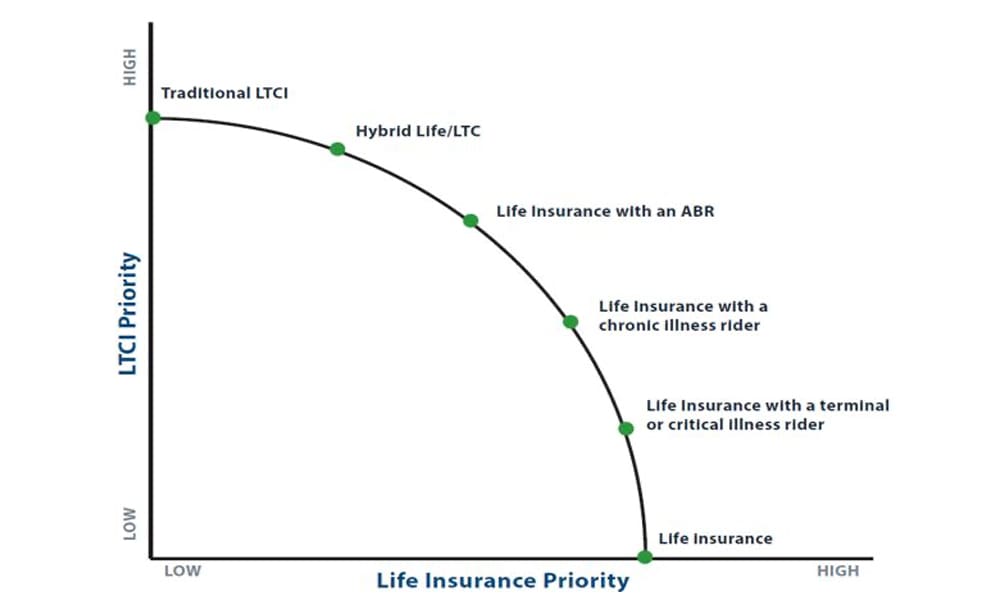

When it comes to safeguarding our future, long-term care insurance offers invaluable protection against the uncertainties of aging and unexpected health challenges. However, navigating the plethora of options available can be daunting. Today, let’s delve into the three primary types of long-term care insurance: Traditional, Hybrid, and Life Insurance with LTC Rider.

1️. Traditional Long-Term Care Insurance:

Traditional LTC insurance operates on a “use it or lose it” basis, providing coverage specifically for long-term care expenses such as nursing home care, assisted living, and in-home care services. Premiums are paid regularly, and benefits are triggered when the insured requires assistance with activities of daily living or suffers from cognitive impairment. While traditional policies offer comprehensive coverage, they require ongoing premium payments and do not provide a death benefit if long-term care isn’t needed.

2️. Hybrid Long-Term Care Insurance:

Hybrid policies combine long-term care coverage with another form of insurance, typically life insurance or annuities. These policies offer a dual benefit by providing long-term care benefits if needed and a death benefit to beneficiaries if care isn’t required. Unlike traditional LTC insurance, premiums are typically paid as a lump sum or over a limited period, and any unused funds can be passed on to heirs. Hybrid policies offer flexibility and protection, making them an attractive option for individuals seeking to maximize their coverage and legacy.

3️. Life Insurance with LTC Rider:

Life insurance policies with LTC riders offer a unique solution by combining life insurance protection with long-term care benefits. Similar to hybrid policies, these riders provide a death benefit to beneficiaries if long-term care isn’t needed, ensuring that premiums aren’t wasted. Additionally, policyholders can access accelerated death benefits to cover long-term care expenses, offering financial security and flexibility during times of need.

Each type of long-term care insurance offers distinct advantages and considerations. Whether opting for traditional coverage, a hybrid policy, or life insurance with an LTC rider, it’s essential to assess individual needs, financial goals, and risk tolerance to determine the most suitable option. By exploring these choices and planning proactively, we can secure peace of mind and protect what matters most—both now and in the years to come.